I’ve always tried to be careful with my money, and kind of know where it’s going by holding back sometimes and spending others. That strategy can work for a little, but definitely not forever. So many people actually have no idea where their money goes and how they are spending it. Once I got my first ‘real’ job, I made it a goal to keep a budget that keeps me accountable for where my money is going.

“Having a budget doesn’t restrict you. It just helps you feel in control for when you buy those heels — because you can.”

When making my budget I wasn’t trying to be stingy or make sure my limits were reasonable, I was trying to make sure they were realistic. And if that means I’m spending $400 on food a month, maybe – but if it works, then its good as far as I’m concerned.

There are so many resources out there for ‘easy’ budgeting where it automatically does everything, which is great. I’ve tried those, but the downfall with the automatic budgeting is that you aren’t held accountable to know where your money goes. You forget to check it and all of a sudden you see you’ve spent $500 on food this month, oh well.

So I decided to make my own budget, exactly how I wanted it, so I have all the control and I am held accountable to keep it accurate and updated. I started with a blank excel sheet. No resources, no apps. I just started to make it like a puzzle, where I had to fit all the categories together to make sure it was complete and worked. It definitely took some time, but it’s so worth it.

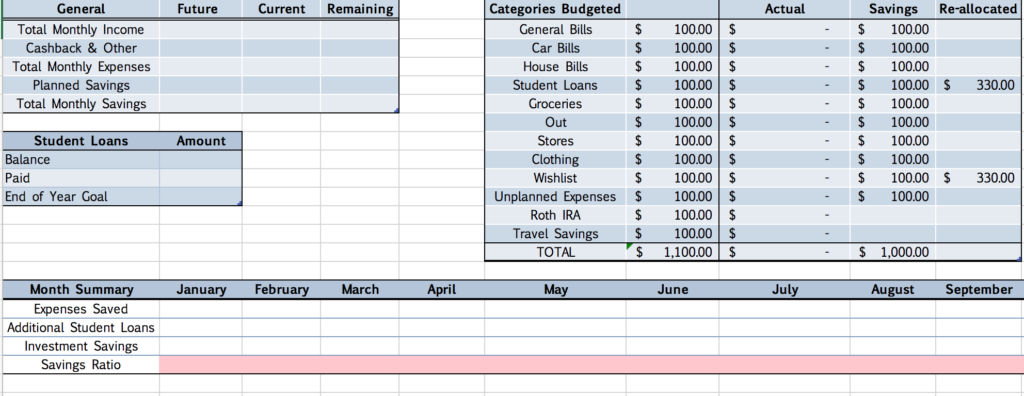

Here’s my summary page:

This is where I input each time I get a paycheck and see how I’m spending my overall categories, how much I’m on track for saving, and how I have done from month to month. This is the information I wanted to know, so I put it in. When I was helping my friend make her budget on excel, her overall page didn’t look like this at all. Which is fine, because it’s whatever works for you.

I’m kind of a nerd when it comes to Excel formulas so I was excited to make it complex and have everything link together. That get’s kind of hard to explain.. but let me know if you want to know because I will do a follow-up! So I linked all the cells with the categories to the sum of each of my category pages.

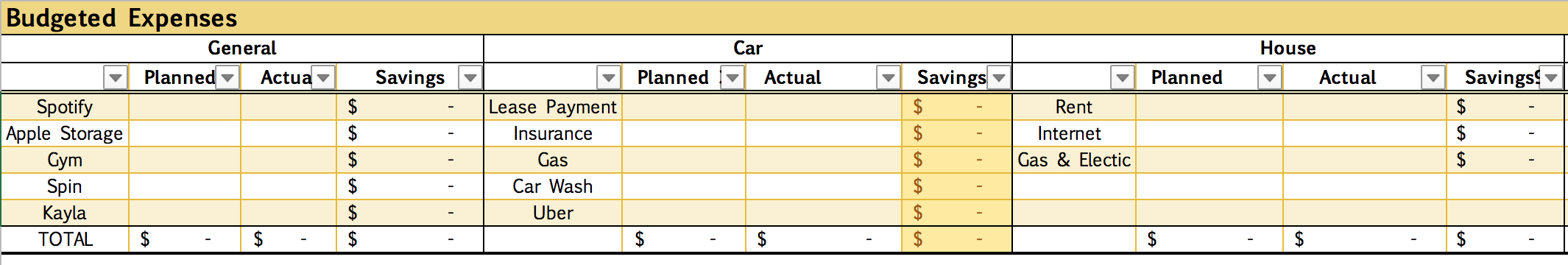

Here is my ‘Bills’ page:

The hard part is figuring out what expenses you have and not forgetting them because they add up fast! It’s basically all an experiment. I have adjusted this many times already – and that’s okay. It’s good actually because that means I am better understanding my spending habits, which will help me stay on track.

But here’s how my budget works:

Say, I go to coffee and buy a $6.20 coffee (ya, regrets), as I just did at the coffee shop I’m at now writing this article. Well, I have to hold myself accountable, so I input it myself on my budget. This may seem like too much work for you to keep up with, and maybe it is, but it’s actually not that time consuming or hard once you have it up. I keep mine up on my computer so at the end of the day I just go to the category and put it in (well, I used the fancy formulas to make it automatically go in the right category – basically my greatest accomplishment.) And really, I don’t buy from more than 3 places a day unless it’s a big spending day, so it takes me less than a minute to put it in my budget. I think we can all spare the minute. My friend keeps it on her phone and updates it that way. It’s whatever works best for you.

I included my budget template for you as a start. Edit it, experiment, and have fun!

Since having this budget I have found:

- I spend a lot of money

- But even when I spend a lot of money, I can still save what I want to

- I’m rarely accurate on all of my categories

- But when I spend over on some, I spend under on others

- It’s better to overbudget than try to hold yourself accountable to ‘ideal’ standards

- I feel so much more in control of my money

- So it justifies all my splurges (okay, maybe not all of them, but some)

- I can make smart decisions

- I LOVE BUDGETING.

CHEERS, CIERRA